Representative example: Myloan is an online loan comparison tool and not a credit provider. We only work with NCR-registered credit providers in South Africa. Our comparison service to consumers is free of charge. Estimated repayments on a loan of R30 000 over 36 months at a maximum annual interest rate of 28% would be R1 360 per month including an initiation fee and monthly service fees. Interest rates charged by credit providers may, however, start as low as 11%. Repayment terms can range from 6 to 72 months.

Capitec is one of the leading digital banks in South Africa. The bank currently has more than 16 million clients who transact, save, insure and use its credit facilities. Capitec has more than 500 retail branches in South Africa. The majority of customers at Capitec transact using the bank’s Global One account. This is a savings account, and credit facility rolled into one.

According to the South African Customer Satisfaction Index, Capitec has the highest customer satisfaction rate with 82.2 points out of 100. The bank offers several loan products, including credit cards, home loans, the access facility, term loans, personal loans, and car loans. Capitec also offers what is known as need-based credit that you can use for your medical costs, education, vehicle, and home improvements.

How to Apply for a Loan at Capitec Bank

There are several ways to apply for a Capitec personalized loan. You can either apply over the phone, through the banking app, in-branch, or online using the banking platform.

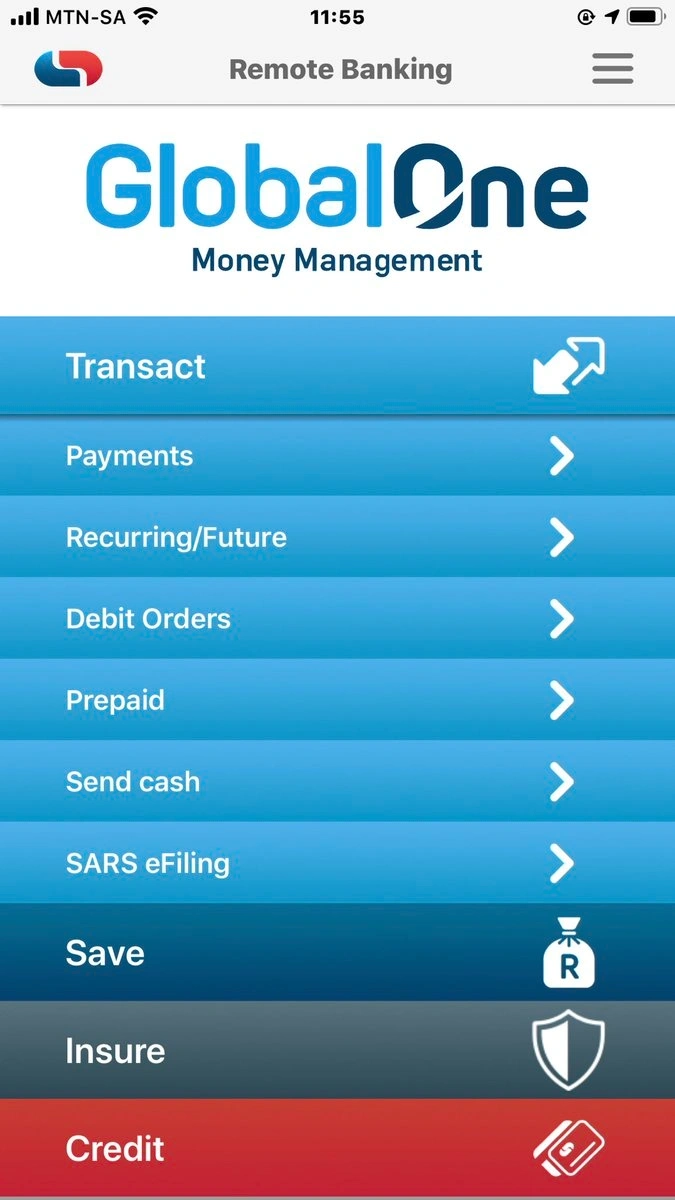

Capitec Banking App

You can apply using the Capitec Mobile app if you are a customer. The app is available for both Android and i0S users. To submit your application, you can log into the app and navigate to loans and applications. The process is quite straightforward since you need to select the amount and term.

Apply at a Capitec Bank Branch Office

You can also submit a loan application directly at a Capitec branch. All you need to do is use the Capitec branch locator to find the branch nearest to your location. When you visit the branch, you must remember to bring an ID, proof of residence, your three-month bank statement, and your proof of income. To access the branch locator, visit https://www.capitecbank.co.za/branch-locator/.

Apply for a Capitec Bank Loan Online

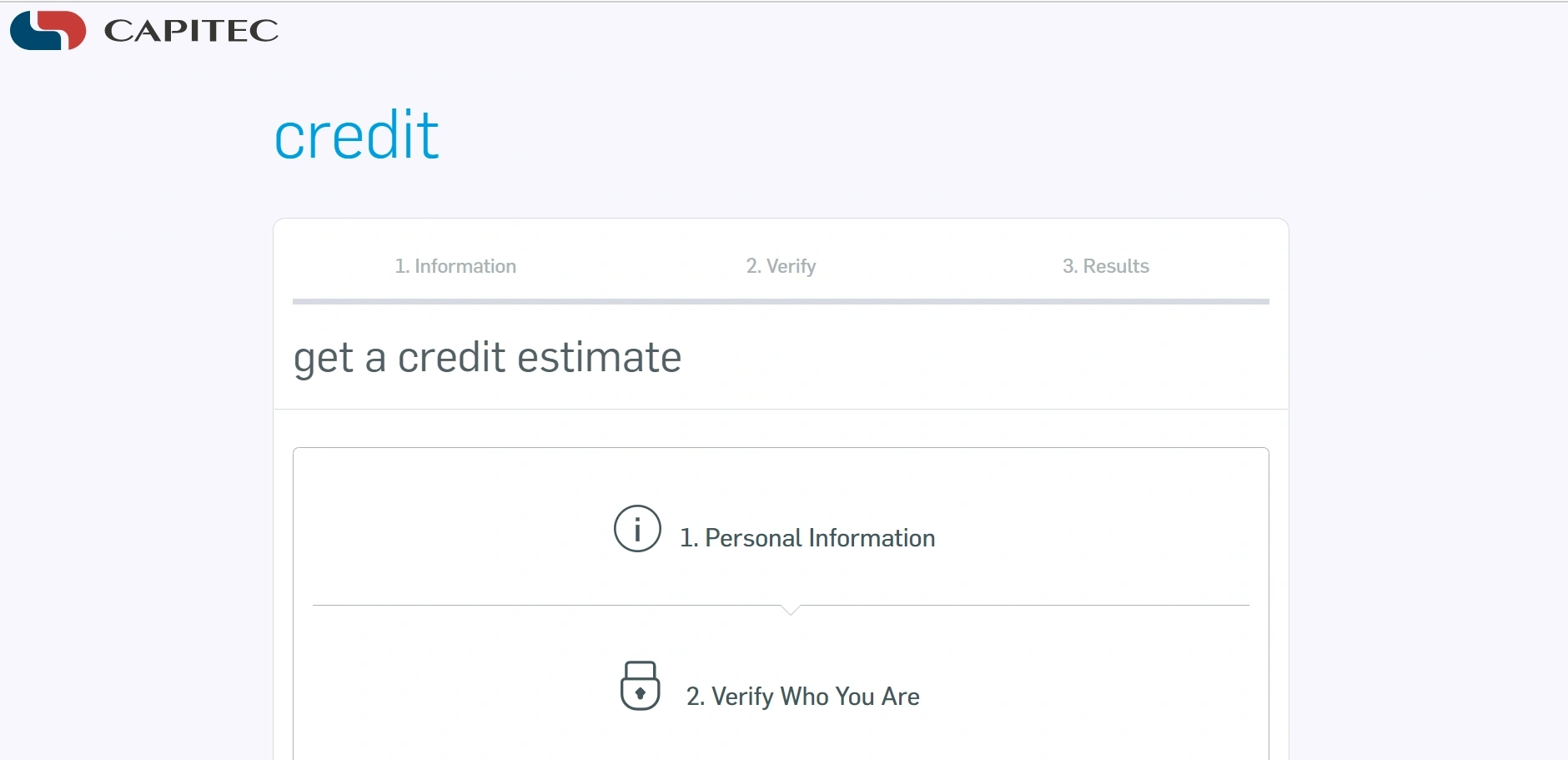

To apply via internet banking, you need to visit the Capitec bank website. The loan option is under the Global One/Get Credit section. The page offers you a chance to get an online estimate of the amount you can get and the repayment amounts based on your information.

However, you must remember that the estimate is not an exact amount. The final amount is determined by several factors, including your credit score and monthly expenses. Once you get the estimate, you can proceed with the three-stage application process.

If you do not bank with Capitec, you will need to first submit your personal information, verify your South African ID and then wait for the results after the bank reviews your information. On the other hand, if you bank with Capitec, you can simply log into your online banking profile and apply from within your account. Since the bank already has your information, there will be no need to submit any documents.

Who Can Get a Capitec Loan?

The Capitec personal loan is available to existing customers and those who do not have accounts with the bank. It is generally easier for existing customers to apply, especially those who receive their salaries through a Capitec account. If you receive your salary through Capitec, you will not be required to provide any documentation. All you need to do is submit your application via the app and wait for approval, which can take minutes.

You can also get approved if you are not a customer, but you will be required to provide documentation. The loan is available to individuals 18 years of age or older. You will need to provide proof of income in the form of three-month bank statements or payslips. You must also attach proof of residence for FICA. The proof of residence should not be older than three months.

Requirements for a Personal Loan from Capitec Bank

To apply for a personal loan at Capitec, you will be required to provide certain documents. Apart from the documentation, you must also have a low credit risk. Your credit risk and your affordability is analyzed by looking at your banking and credit history. Individuals with a high credit risk might not be able to get a loan. Even if the loan is approved, high credit risk can limit the amount you get.

Your credit risk will also affect your interest rates. In general, high credit risk means a high-interest rate. Before approving your loan amount, the bank also looks at your income and expense to determine your affordability. If you want to qualify for a loan at Capitec, here are some of the documents that should accompany your loan application:

Original South African ID document proving you are 18 years or older.

A marriage certificate or divorce court order will be required if your surname is different from what’s on your ID.

Proof of income in the form of a three months bank statement or latest payslips

Benefits of Applying for a Personal Loan at Capitec Bank

The Capitec personal loan program is designed for individuals over 18. Like every other personal loan provider, Capitec offers this loan facility to people who have a steady source of income. This means you will need to either be employed or run a business of your own.

Personal loans at Capitec have variable interest rates which start at 12.9%. This interest rate you get on your loan is dependent on several things including the term and your credit history. Capitec offers personal loans of up to R250,000. Again, like the interest rate, the amount you get depends on income and your credit history. Here are some of the advantages of getting a personal loan from Capitec.

One Type of Personal Loan

Capitec personal loans are one of the most refined financial solutions in South Africa. Unlike other banks, Capitec only offers one type of personal loan. This gives them an advantage as they can constantly work to refine their personal loan offering.

Longer Repayment Term

Capitec’s personalized loan has longer payment terms than personal loans from other banks. It comes with repayment terms of up to 84 months. However, this implies that you may end up paying a higher interest rate.

Simple and Quick Application Process

The Capitec personalized loan has a simplified application process. To apply for a loan at Capitec, you can either visit a branch, use their web platform, or use a mobile app. Applications through the mobile app can take minutes.

One thing to note is that you can also apply for a Capitec personal loan even if you are not a Capitec customer. However, depending on document availability, the application can take more than a day for non-customers. If you are an existing Capitec customer and receive your salary in the same account, you will not be required to provide any documentation.

Here are some of the benefits of the Capitec Personal loan:

Quick approval, within minutes

Fixed monthly installments

Interest rate is as low as 12.9%

Longer payment terms

You can consolidate your existing loans for more manageable monthly repayments

Affordable retrenchment and death credit insurance

Easily manage the loan via the Capitec app

You can borrow up to R250,000 depending on your income

Variable interest rate according to your credit score

Find the Best Personal Loan in South Africa

Are you in need of extra cash? One way to find a personal loan is to approach a bank. However, it is not advised to apply for the first personal loan offer you get. There are many loan providers in South Africa, so should find the best one. Unfortunately, visiting every bank and loan provider's website will take time, and the amount of information you have to go through can be overwhelming.

What if you could find a collection of loan offers and easily compare them to find the option that suits your needs? Well, that’s exactly what MyLoan does. Whether you need money for an emergency, a car, or even a holiday, you can use MyLoan to find the best deals by comparing personal loans from the best South African lenders. All lenders that you find on the MyLoan website are registered credit providers.